Top

Ranking

Favorites

Trending tokens

Latest news

Trending topics

Latest feed

Disclaimer: The content on this page is provided by third parties. See T&Cs.

⚠️BWENEWS: Brad Garlinghouse (@bgarlinghouse): This is it – the moment we’ve been waiting for. The SEC will drop its appeal – a resounding victory for Ripple, for crypto, every way you look at it.

The future is bright. Let's build.

⚠️方程式新闻: Brad Garlinghouse (@bgarlinghouse):这就是我们期待已久的时刻。美国证券交易委员会将放弃上诉,无论从哪个角度看,这都是 Ripple 和加密货币的一次巨大胜利。

未来是光明的。让我们一起建设吧。

$XRP

PRODUCT UPDATE

With our recent SEND Aggregator revamp, you can now choose your preferred swap route.

Click "Detail" to view the swap route results between @AftermathFi, @CetusProtocol, and @7k_ag_.

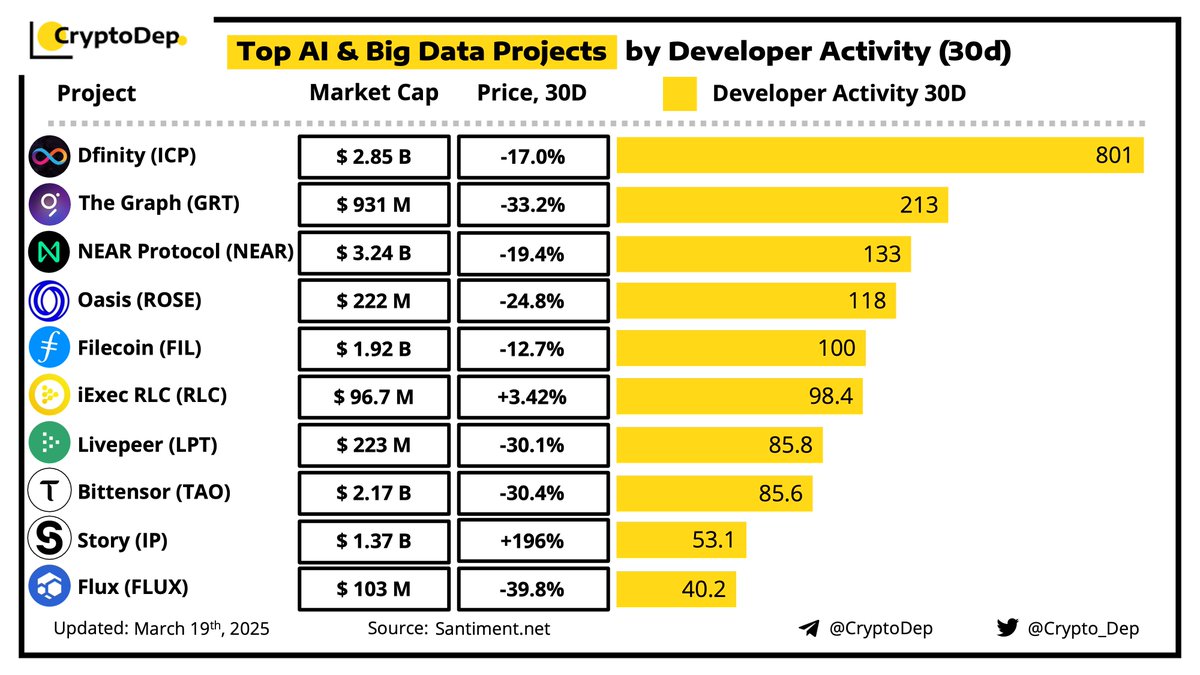

⚡️ Top AI & Big Data Projects by Developer Activity (30d)

Dev.Activity - the development activity of a project done in its public @Github repositories. Development Activity metrics are measured in number of Github events.

#ICP - 801

#TheGraph - 213

#NEAR - 133

#Oasis - 118

#Filecoin - 100

#iExec - 98.4

#Livepeer - 85.8

#Bittensor - 85.6

#Story - 53.1

#Flux - 40.2

Data Source: @SantimentFeed

$ICP $GRT $FIL $NEAR $IP $ROSE $RLC $LPT $FLUX $TAO

North Carolina Senators have put forward a proposal to allocate up to 10% of public funds into Bitcoin investments.

The current Crypto Fear & Greed Index is at 23 (Fear). This is a -2 change from yesterday, a +4 change from last week, and a -15 change from last month.

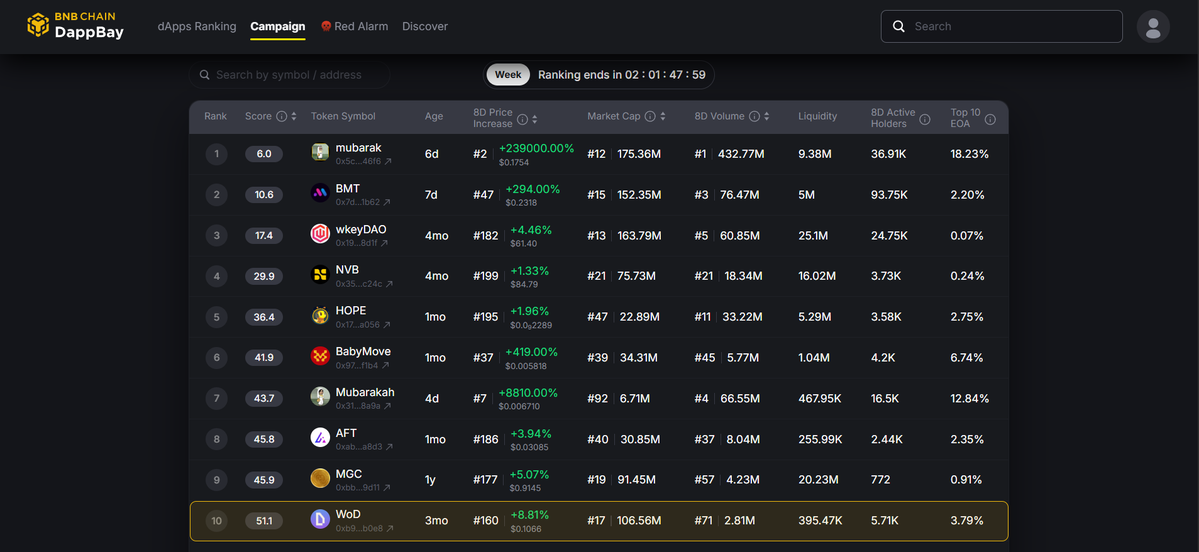

🚀 We are officially in the Top 10 spot on @BNBCHAIN's LP Support Weekly Competition! With a 6.88% price increase and growing momentum, $WOD continues to thrive.

This is just the beginning, and we’re ready for even bigger milestones ahead!

👉

People in #SPX6900 have integrity, patience and conviction.

Something that is incredibly rare in the crypto industry.

Only comparable to Bitcoin.

This fact alone should make you study $SPX obsessively.

💹🧲

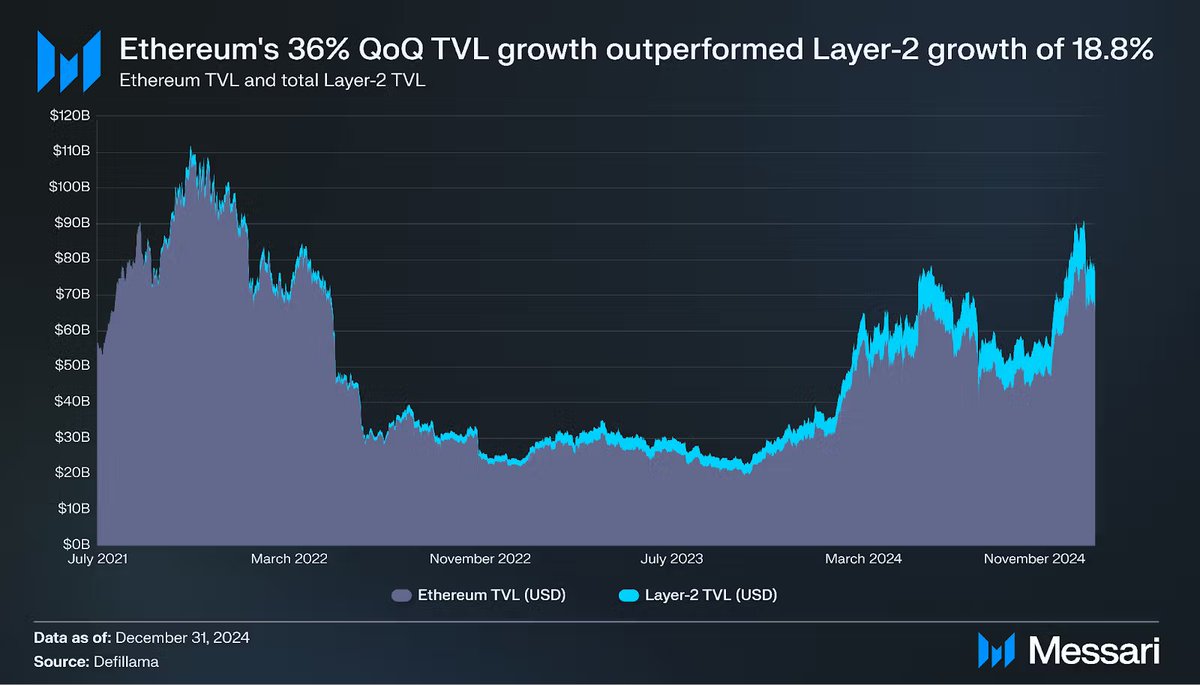

Despite the heavy ETF outflows of the last month and $ETH dropping below $2,000, Ethereum is doing pretty well, opposite to what many want you to believe.

As @DrxlEth outlined in a recent report on @MessariCrypto, several indicators show that the network has grown QoQ and YoY.

1.) Ethereum Parasites

The first interesting thing to note is Ethereum outperformed all major L2s in TVL growth aside from Base [First image below].

It looks like Layer 2s aren't parasites to Ethereum, as everyone wants you to think.

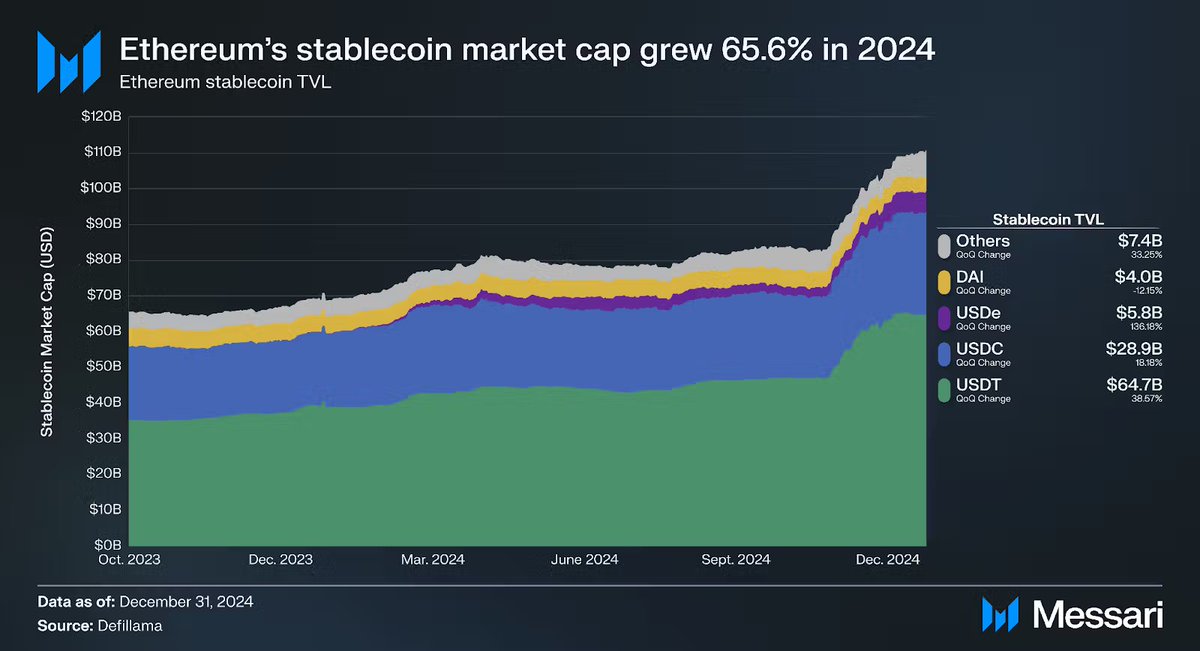

2.) Total Stablecoin Market Cap

This metric surged 65.6% YoY, passing from $66.9 billion to $110.8 billion at the end of 2024 [Image n°2].

Currently, it stands even higher at $123.8 billion, accounting for 54% of the total supply across all networks.

I believe with RWAs gaining more traction and institutions entering the space, this huge market share becomes the biggest competitive advantage of Ethereum over any other network.

No one is too big to fail, but Ethereum is in a position where it's very hard to take down.

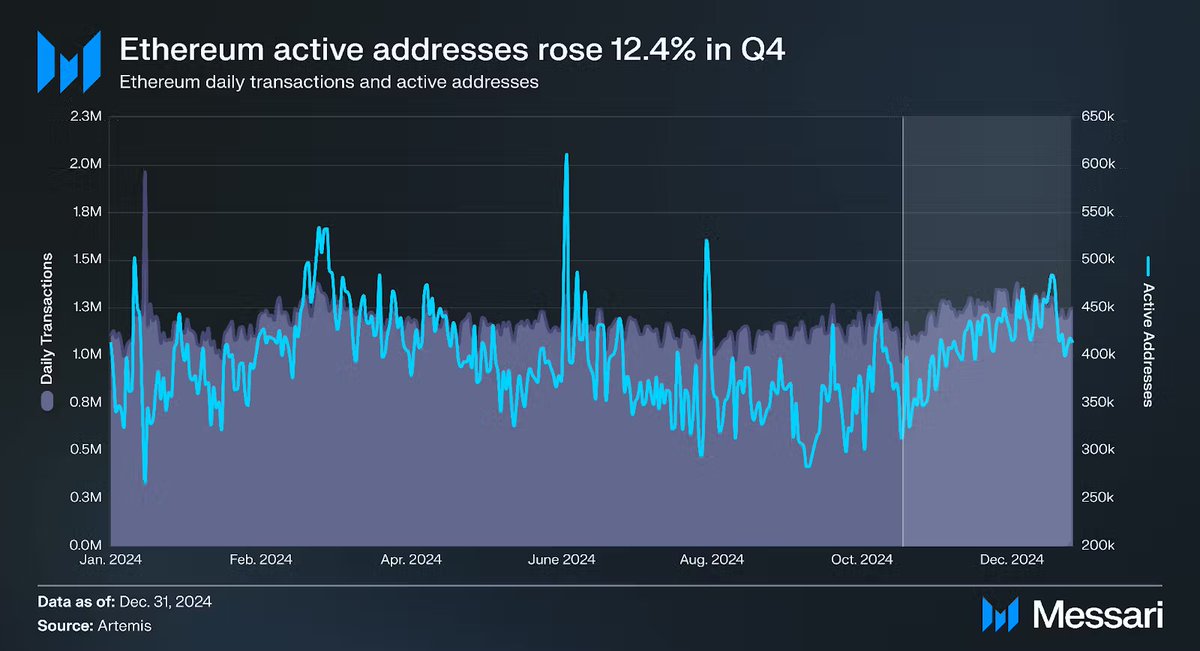

3.) Onchain Activity

YoY activity increased by 13.3% while average average daily active addresses (DAAs) remained stable.

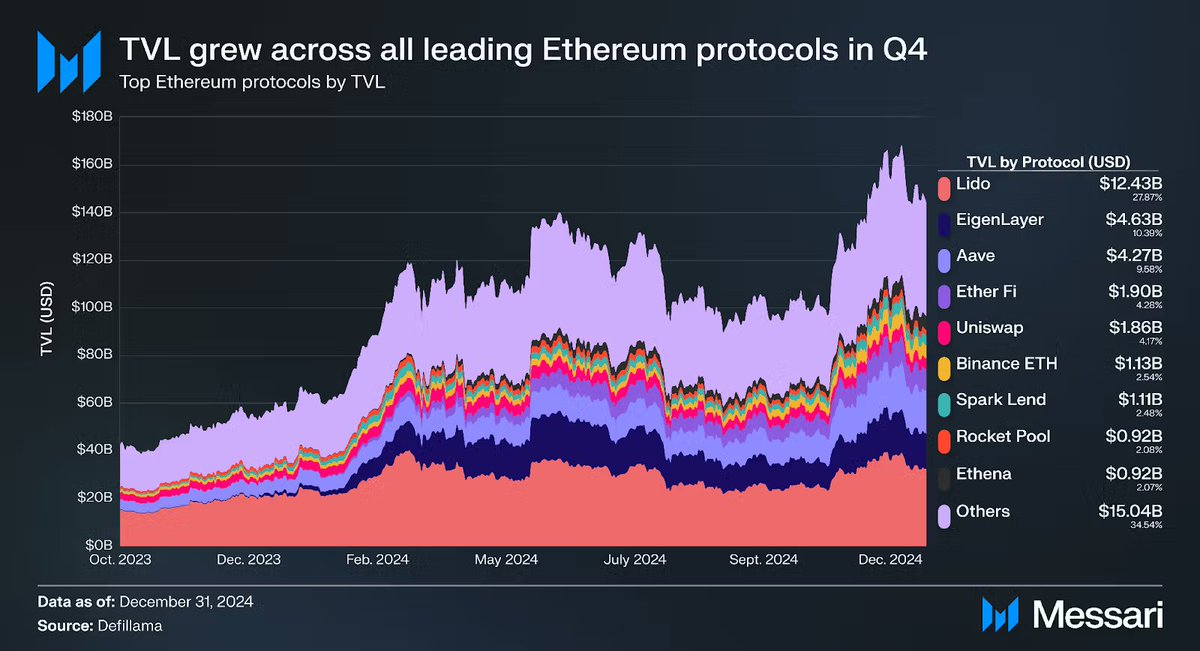

@aave was the protocol with the sharpest growth, as its TVL grew from $12.6 billion to $23.2 billion in Q4 of the past year.

Currently, among the top lending platforms, it's the one whose TVL has been hit the least in the past couple of months, showcasing very good relative strength.

With Horizon, their institutional-focused platform, this trend will likely continue.

Trending investments

You may also like